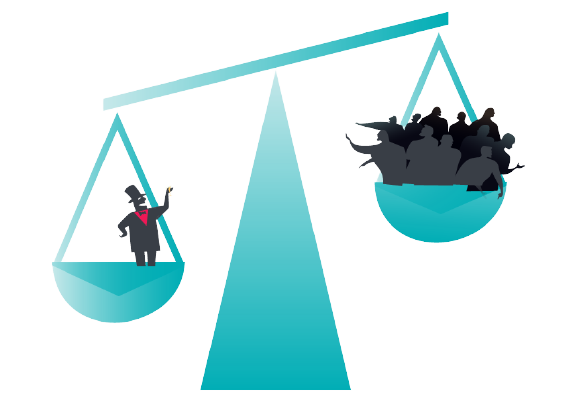

Private sector’s role in creating a more egalitarian society

The financial crisis of 2007-2008 revealed the urgent need for countries to rethink their capitalism models. The effect of the crash is still being felt globally as we face the most destructive crisis of inequality due to the ever-increasing gap between the wealthiest few and the rest of society.

Economic and societal inequality has led to calls for governments to implement policies to address the destabilising outcome of years of focusing mostly on free market principles. Experts like Mariana Mazzucato are advocating for governments to play more active roles beyond market fixing policies such as regulations and high taxation regimes by driving innovation using a mission-oriented approach to solve societal challenges like lack of jobs, poor access to education and health care and fall in living standards, by involving multiple societal actors and sectors.

There has also been a renewed consciousness regarding the important role played by the private sector to ensure that they take into consideration the interest of all their stakeholders, not just the shareholders, when conducting their business- in other words private companies need to move away from focussing on maximising value for just shareholders to engaging in stakeholder value maximisation.

Simply put, the notion of value is based on how companies’ activities are organised, how outputs are produced and how earnings from businesses are applied. Also, beyond earnings, companies seek to be profitable (total revenue exceeding total expenses) to ensure adequate funding of business operations in the future. This is the basis for the famous 1970 article by the economist, Milton Friedman -“the Social Responsibility of Business is to Increase its Profits” where he directed companies’ management to make maximising profits for shareholders their key focus.

In 1976, early proponents of shareholder value maximisation, Michael Jensen and William Meckling, went on to say that the only way to ensure that companies were well run and that the interest of risk-taking investors were met, was by assessment of their share prices. Today, this model remains largely the dominant corporate governance system.

Profit is good. The shareholder value maximisation model is meant to ensure that organisations’ resources are judiciously applied for higher incomes to be retained and reinvested in the business, as well as for dividend pay-out to the owners of businesses. However, in a number of cases, the practice of shareholder value maximisation has resulted in value extracting outcomes namely, exponential growth in management pay packages and share options; reduction of shareholding duration and company investments; unscrupulous business practices; and exploitation of workers and communities which have all contributed to societal inequality.

The incentives for businesses to ensure pay-outs to investors and reward for management has led to interest in making quarterly profits attractive rather than making long-term and R&D investments. This has also encouraged unscrupulous and fraudulent business practices over the years, like the famous US’s Enron and UK’s Rover cases, as management are more interested in window dressings and creative reporting.

Most unfavourable of consequences of this model on society is the fact that in some cases, in order for profits to be maximised, employee wages are being kept low resulting in increased job insecurity. This has resulted in widening pay inequality globally. Additionally, the quest for shareholder maximisation has also led to several extractive multinational companies exploiting communities in developing countries, leading to disenfranchised communities and societal inequality.

Therefore, the call to action is for governments to consider using regulations like implementing a minimum acceptable shareholding duration or imposing higher taxation on quick trades as promoted by economist, Mariana Mazzucato, to discourage short-termism so that companies shift their focus away from their quarterly performance and more on long-term investments.

Another consideration is for companies, to build on the Business Roundtable’s (BRT)-CEOs of nearly 200 US companies- 2019 commitment to redefine their purpose from shareholder value maximisation to delivering value to all their stakeholders. BRT’s statement is a departure from previous statements supporting value maximisation for shareholders. Consequently, companies should not just focus on periodic Corporate Social Investment activities but should be incentivised to follow a more robust and sustainable model that considers the interest of all their stakeholders- investors/shareholders, customers, workers, communities and work collaboratively to deliver value for all towards a more equal society.

Author